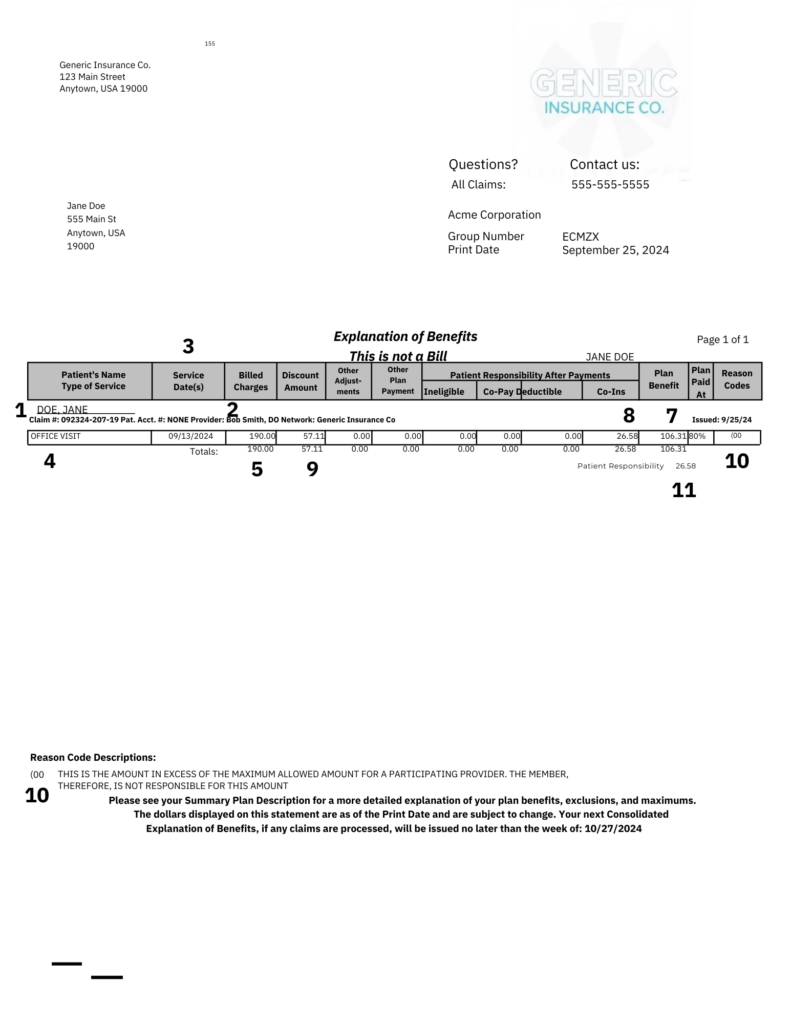

If you’ve ever had a medical visit and received a confusing piece of paper in the mail with lots of numbers, terms, and codes, welcome to the world of the Explanation of Benefits (EOB). For those unfamiliar, the EOB is your health insurance company’s way of explaining what happened behind the scenes when your provider billed them for your care. It’s not a bill, but it’s full of valuable information that can help you understand your benefits and make sure you’re not overpaying.

Let’s break it down step by step so that even if you’ve never seen one before, you’ll feel confident deciphering it.

What Is an EOB?

An Explanation of Benefits (EOB) is a statement sent by your health insurance company that explains:

- What medical services you received.

- How much your provider charged.

- How much your insurance covered.

- What you may owe (if anything).

Think of it as a receipt and summary of your claim, not a bill. The actual bill comes from your provider if you owe anything after insurance pays their share.

Key Sections of an EOB

Most EOBs have a standard format with a few common sections. Let’s go over them one by one.

- 1. Patient Information

- 1 – This section identifies who the claim is for (you, your spouse, or a dependent).

- Check this first to make sure the services listed are for the correct person.

- 2. Provider and Service Details

- Provider Name: 2 – Who rendered the service (doctor, hospital, lab, etc.).

- Service Date: 3 – The date you received care.

- Service Description: 4 – A brief summary of what was done, like “office visit,” “X-ray,” or “lab test.”

- CPT/Service Code: A shorthand billing code for the service provided. While this may not mean much to you, it’s essential for accurate billing.

- 3. Claim Information

- Amount Billed: 5 – The total cost of the services before insurance adjustments.

- Allowed Amount: 6 – The amount your insurance has agreed to pay for that service. (This is usually less than the amount billed.)

- Insurance Payment: 7 – How much your insurer paid toward the claim.

- Patient Responsibility: 8 – What you owe after insurance adjustments and payments. This might include your copay, deductible, or coinsurance.

- 4. Plan Adjustments

- Discount/Adjustment: 9 – The difference between what was billed and what insurance agreed to pay. (This is often due to a negotiated rate between the provider and insurer.)

- If you’re curious why the adjustment is so large or small, this reflects the power of insurance contracts.

- 5. Reason Codes or Messages

- 10 – These explain why certain charges were denied, reduced, or not covered. For example:

- “Service not covered under your plan.”

- “Deductible not met.”

- “Duplicate claim.”

- These codes can seem cryptic, but a glossary or explanation is often included. If it’s unclear, call your insurance company.

- 10 – These explain why certain charges were denied, reduced, or not covered. For example:

- 6. Total Responsibility

- 11 – This is the big number: what you’re expected to pay. Compare it to your actual bill to ensure they match.

How to Double-Check Your EOB

Now that you know what’s on the EOB, let’s make sure it all adds up:

1. Match the Date and Service: Confirm the services listed match the care you received. Mistakes happen, so flag anything unfamiliar.

2. Check Your Coverage: Ensure your insurance applied your benefits correctly. Did they cover what they should? Are you being charged more than expected?

3. Compare to the Bill: If you receive a bill from your provider, compare it to the EOB. They should align, but if they don’t, call your provider or insurer to resolve discrepancies.

What If There’s a Problem?

If something doesn’t look right:

• Call your insurance company: Use the member services number on your EOB or insurance card. Have your EOB and any provider bills handy.

• Contact your provider: If the issue is with the billed amount, your provider can clarify or correct mistakes.

• Ask for help: If it’s overwhelming, consider reaching out to a medical billing advocate or someone knowledgeable in medical billing.

Pro Tips

• Keep Your EOBs: They’re useful for tax purposes, appeals, or disputes. If paper copies clutter your life, many insurers offer digital EOBs through their websites.

• Track Your Deductible and Out-of-Pocket Max: EOBs often show your progress toward these amounts. Understanding where you stand can prevent surprises later.

• Know It’s Not a Bill: EOBs are for your information. Wait for an actual bill before paying anything.

Final Thoughts

Understanding your EOB might feel like cracking a code at first, but with a little practice, you’ll soon see it for what it is—a snapshot of your health care costs and coverage. It’s one of the best tools you have to ensure transparency in the often-murky waters of medical billing.

Take it step by step, ask questions when needed, and remember: you’ve got this!